Adasina Social Capital

Adasina is your bridge between financial markets and social justice.

We believe that transformed systems are best created by people outside of traditional power structures who carry new perspectives. By building a diverse team that reflects the communities for which we seek justice, we created a new kind of investing based on the needs of those most impacted by our existing inequitable systems.

In partnership with social justice organizations within these communities, we define the criteria that guide our investments. We use this community-sourced wisdom to educate and mobilize other investors with campaigns that amplify the needs, perspectives, and voices of impacted communities throughout the financial system.

How data is collected matters.

Adasina-sponsored data hub is a free, one-stop platform that aggregates data on the racial, human rights, economic, and climate impacts of publicly traded companies. Previously known as BRIDGE, the data hub leverages data and metrics from leading social justice organizations, to empower communities that are often left out and most negatively impacted by financial decisions.

Individuals, investors, institutions, and financial professionals with social justice values use the hub to see a complete and intersectional picture of whether and how their investments may contribute to harmful practices and systemic injustices.

Clear Distinctions: Understanding Adasina-Sponsored Exclusion Lists

The datasets within the Adasina-sponsored data hub are exclusion lists, meaning companies are either included on the list or they are not. These lists identify companies engaged in social and environmental harm, helping investors and advocates make informed decisions—whether to divest from or engage with these companies based on their impact.

Unlike other datasets, such as those from As You Sow, these exclusion lists serve a distinct purpose and cannot be categorized in the same way.

Exclusion Lists: A Key Tool for Ethical and Responsible Investing

Divestment – If an investor wants to avoid companies involved in harmful activities (e.g., fossil fuels, weapons, human rights abuses), they use exclusion lists to screen out those companies from their portfolio. This aligns investments with their values.

Engagement – Some investors don’t immediately divest but instead use the data to pressure companies to change. By identifying problem areas (e.g., poor Indigenous rights practices), they can push for better policies before deciding to divest.

Contributors to Adasina-Sponsored Data Hub

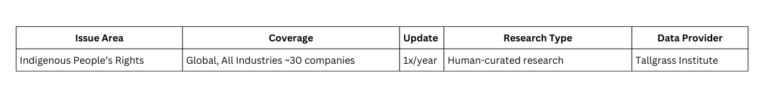

Tallgrass Institute

Tallgrass Institute works from a foundation of Indigenous values to achieve a sustainable future for all. They are a leader in deploying strategies to move the market toward respect for the rights of Indigenous Peoples. It is an Indigenous-led organization that translates on-the-ground impacts of investment affecting Indigenous Peoples to corporate decision-makers through the intersection of business, law, and finance.

Tallgrass Institute translates on-the-ground impacts of investment to corporate decision-makers and increases corporate accountability to Indigenous Peoples at the intersection of business, law, and finance.

Their strategies to build the business case for Indigenous Peoples include corporate engagement, international advocacy, capacity building, network facilitation, and research.

They manage data set which includes publicly traded companies that infringe on Indigenous Peoples rights by:

- Demonstrating a pattern, practice, or perpetuating a violation of the rights and protections of Indigenous Peoples,

- Demonstrating a pattern, practice, or perpetuating criminal or exploitative behavior towards Indigenous Peoples,

- Using explicit cultural appropriation of Indigenous culture and imagery,

- Deploying capital that infringes on Indigenous land rights, and

- Desecrating sacred places.

Tallgrass Institute uses a mix of qualitative and quantitative sources including news and media, industry associations, company disclosures, and more to identify companies that are engaged in these five behaviors.

The dataset is reviewed and updated annually.

For more information, please visit www.tallgrassinstitute.org

Adasina Social Capital

Adasina Social Capital is an investment firm dedicated to social justice through financial activism. They integrate advocacy and investing to influence capital flows toward racial, gender, economic, and climate justice. Adasina works by aligning financial markets with movements for social change, ensuring that investment decisions reflect the needs of historically marginalized communities.

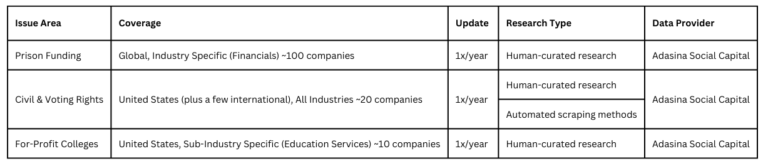

As the provider of the For-Profit College, Civil and Voting Rights, and Prison Funding datasets, Adasina applies its expertise in financial activism to track corporate behaviors that impact these critical social issues.

The For-Profit Colleges Investor Dataset

The For-Profit Colleges Investor Dataset, driven by Adasina Social Capital research, focuses on companies that specifically target low-income students, people of color, single parents, and veterans. These students are left with mountains of debt and without the means to pay for it. For-profit colleges account for 13% of the population, but 33% of federal loan defaults. The dataset describes publicly traded companies that are or own for-profit colleges in the United States. The companies in this dataset are identified by having publicly traded status, offering a 4-year degree, accept student loans. These companies are identified through qualitative research methods. The dataset is updated annually.

The Prison Funding Investor Dataset

The Prison Funding Investor Dataset, driven by Adasina Social Capital research, focuses on companies that hold debt or equity investments in mass incarceration. These investments are identified as equity or debt holdings of two publicly traded companies that own and manage private prisons and detention centers; CoreCivic and GeoGroup. The dataset is updated annually and is sourced from company disclosures.

The American prison system is massive. So massive that its estimated turnover of $74 billion eclipses the GDP of 133 nations. While much of the funding comes from US tax dollars, the prison industrial complex is so big it needs more funding than taxpayers are willing to pay, so the financial industry also funds it. Along with focusing on which companies profit from mass incarceration, we think it is important to also look at who is funding the system. Bonds are financial vehicles that are loans given at an interest rate. The prison funding criteria are banks and financial institutions that have issued bonds (loaned money) to build prisons and maintain the incarceration system.

For more information, please contact impact@adasina.com

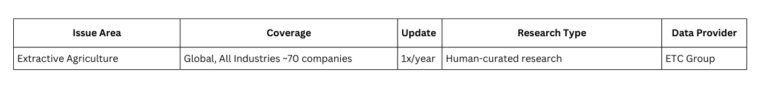

ETC Group

ETC Group is a global organization with direct farmer engagement worldwide. For nearly 40 years, they have documented the damaging effects of soil erosion, corporate consolidation, and technology infiltration in agriculture. Their research spans India and the Philippines to Canada, and has enabled us to build an international coalition of climate justice advocates.

ETC Group is also a principal resource and reference on corporate concentration and related issues for civil society and grassroots movements generally. They regularly publish Top 10 lists ranking the most powerful corporations in a range of industrial agricultural sectors.

Tracking Corporate Control and Harm in Global Agriculture

The Extractive Agriculture Investor Dataset

The Extractive Agriculture Investor Dataset, driven by ETC Group research, focuses on a food system that contributes to climate change and displaces farmers and families throughout the global south. Industrial agriculture uses at least 75% of the world’s agricultural resources to provide food for less than 30% of the global population.

Extractive Agriculture is a driver of climate change as it is responsible for 1/3 of all greenhouse gas emissions, disproportionately impacts those in the global south and domestically based on race and gender, increases poverty, works against against the UN Sustainable Development Goals and is in violation of the Indigenous principles of Free, Prior and Informed Consent and causing displacement in global south.

ETC Group’s research on corporate rankings and estimated market share is conducted in a straightforward way: they identify the leading companies and determine their revenue in a given sector for a particular calendar year; they then calculate the company’s global market share by dividing the value of its sector revenue by the estimated value of the sector’s global market. Because of this, they require accurate data on a company’s annual sector sales as well as an accurate evaluation of the global market for each sector (detailed information on specific sectors follows, below). The “concentration ratio” – that is, the sum of the market shares of the largest companies in a given sector – can provide meaningful information about how competitive and innovative a sector is likely to be. ETC Group believes that high levels of corporate concentration in agriculture, even at levels below the traditional threshold of oligopoly, pose a threat to world food security.

The data provider for the Extractive Agriculture dataset, ETC Group updates the dataset annually and measures issues related to Extractive Agriculture & Foods in terms of:

- Corporate concentration in the commercial seed and agrochemical/pesticides sector

- Corporate concentration in the agricultural fertilizer sector Genetic engineering (GE) used to alter the genetic material of an organism, e.g. plant or animal, in the context of food and agriculture

- Corporate concentration in commodity traders that produce, procure, process, transport, finance and trade grains, food, fiber, meat, livestock, sugar, etc. on a global or regional scale

- Corporate concentration in farm machinery sector used in the context of food and agriculture

- Corporate concentration in dairy and meat processing and meatpacking, which includes rearing, slaughtering, packaging and distribution of animal and alternative proteins

- Corporate concentration in animal pharmaceutical sector

- Corporate concentration in animal genetics and reproductive technologies for livestock, aquaculture and seafood

- Corporate concentration in post-harvest processing of raw agricultural commodities into edible consumer products

- Corporate concentration in retail of perishable and non-perishable foods to consumers

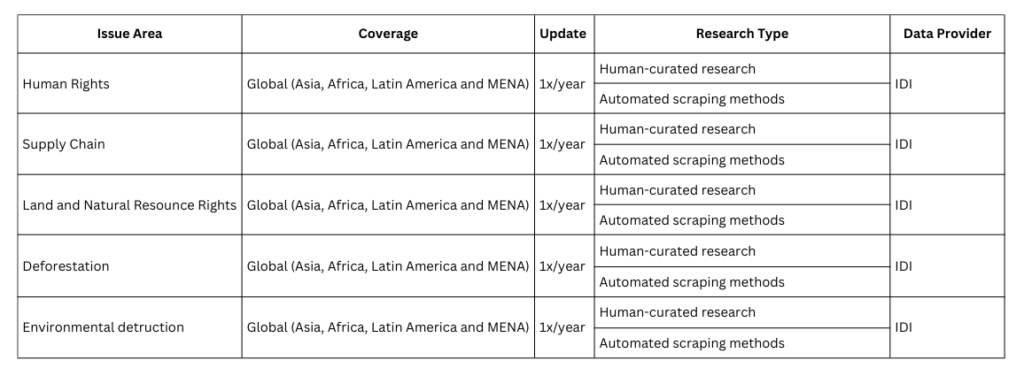

Inclusive Development International (IDI)

Inclusive Development International (IDI) works to support communities and individuals who are negatively impacted by large-scale development projects, such as infrastructure development, land acquisition, and natural resource exploitation. Founded in 2012, IDI focuses on promoting human rights and equitable development by providing affected communities with the tools, knowledge, and resources necessary to articulate their interests and defend their rights.

Additionally, IDI actively participates in research and policy work to influence international development norms and promote alternative models of inclusive development. By collaborating with grassroots organizations, civil society groups, and international partners, Inclusive Development International strives to ensure that development projects are conducted in a manner that respects human rights and fosters sustainable economic and social benefits for all stakeholders involved.

Database Tracks Publicly Traded Companies Linked to Human Rights and Environmental Abuses

Inclusive Development International manages dataset which includes publicly traded companies that are implicated in human rights abuses, environmental destruction, and other harms to local communities. Inclusive Development International conducts qualitative studies, contracted by various indigenous and local communities across the globe, to detail the harms large corporations impose on local communities and the environment. As Inclusive Development International conducts its research, the names of these companies are catologed annually and hosted on the As You Know database. Companies implicated in issues over 3 years ago are removed from the list.

For more information, please visit www.inclusivedevelopment.net

One Fair Wage

One Fair Wage is a national organization of nearly 300,000 restaurant and service workers, nearly 1,000 restaurant owners, and dozens of organizations nationwide all working together to end all subminimum wages in the United States and raise wages and working conditions in the service sector in particular. One Fair Wage policy would require all employers to pay the full minimum wage with fair, non-discriminatory tips on top, thus lifting millions of tipped and subminimum wage workers nationally out of poverty.

The One Fair Wage coalition includes all workers for whom tips are considered wage replacement – including restaurant workers, nail salon technicians, car wash workers, tech platform delivery workers and drivers, hairdressers, massage therapists, and many more – as well as other subminimum wage workers, including disabled, incarcerated and youth workers. One Fair Wage conducts policy advocacy, voter engagement, worker and employer organizing, and culture shift activities to ultimately lift more than 20 million tipped and sub-minimum wage workers nationally out of poverty.

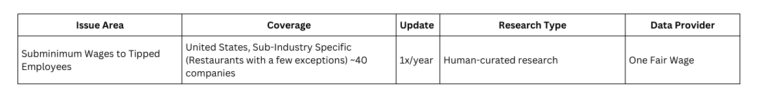

Tracking Major Restaurant Chains That Pay Tipped Workers a Subminimum Wage

One Fair Wage reached out to dozens of large companies to ask if they pay any of their employees the subminimum wage for tipped workers. They included companies who were listed in publicly available databases that met the following criteria: U.S. based publicly traded companies that are listed as full-service restaurants and, therefore, might employ tipped workers. When companies indicated that they do pay a subminimum wage to tipped workers in any location or subsidiary, they were listed as “Pays a Subminimum Wage to Tipped Employees”.

The dataset is updated annually by Adasina Social Capital by conducting a ‘follow-up’ inquiry, giving companies present in the dataset an opportunity to update their status and be removed from the list as well as engaging with companies that have become publicly traded since the initial research was conducted.

meaningful impact around the corner

Lead the change in sustainability

We’re revolutionizing sustainability with innovative ESG solutions on a daily basis, you could join us to do the same. We offer deep data you can use to go into a greener future and make a lasting impact on our planet.